Net income for 43 U.S. oil producers totaled $28 billion in 2018, a five-year high. Based on net income, 2018 was the most profitable year for these U.S. oil producers since 2013, despite crude oil prices that were lower in 2018 than in 2013 on an annual average basis.

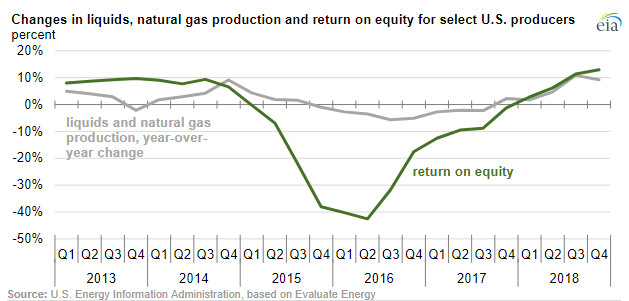

Lower production costs per barrel of oil equivalent (BOE) and increased production levels contributed to a higher return on equity for these companies for the fourth quarter of 2018 than in any quarter from 2013 through 2018.

The companies included in the analysis are listed on U.S. stock exchanges, and as public companies, they must submit financial reports to the U.S. Securities and Exchange Commission. EIA calculates that these companies accounted for about one-third of total U.S. crude oil and natural gas liquids production in the fourth quarter of 2018. However, these companies were not selected as a statistically representative sample but instead because their results are publically available. Their results do not necessarily represent the U.S. oil production industry as a whole.

Most of these companies operate in Lower 48 U.S. onshore basins, with some in the Federal Offshore Gulf of Mexico and Alaska, and some in several other regions across the globe. Because of various corporate mergers and acquisitions in 2018, the number of U.S. producers that EIA examined in this analysis fell from 46 companies in 2017 to 43 companies in 2018.

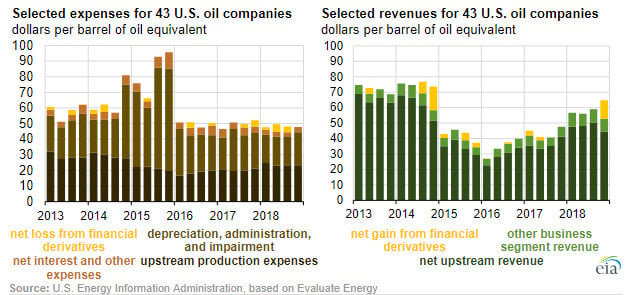

The aggregated income statements for these 43 companies reveal a trend of relatively low increases in expenses directly related to upstream production in 2018. Although these upstream production expenses per barrel typically correlate with crude oil prices, the magnitude of these increases in 2018 was small compared with the increase in prices.

The annual average West Texas Intermediate (WTI) crude oil price increased 28% from 2017 to average $65 per barrel (b) in 2018, but expenses directly related to upstream production activities increased 16% between 2017 and 2018 to $24/BOE. When including depreciation, impairments, and other costs not directly related to upstream production, expenses for these 43 companies averaged $48/BOE in 2018, the lowest amount from 2013 to 2018.

In contrast to production expenses, between 2017 and 2018, upstream revenue for these 43 companies increased 31% to average $48/BOE in 2018, mainly because of the increases in average energy prices and production. As crude oil prices fell in late 2018, their upstream revenue declined 11% between the third and fourth quarters of 2018.

However, this group of companies reported financially hedging nearly one-third of their fourth-quarter 2018 production at prices in the mid-$50/b range, offsetting revenue declines when WTI prices fell lower than $50/b by the end of the year. Consequently, even with their decline in upstream revenue in the last quarter of 2018, total revenue increased for these 43 companies because of the gains from financial derivatives.

Contributions to revenue from derivative hedges—which increase in value when prices decline—for these 43 companies reached the largest total for any quarter since the fourth quarter of 2014. Financial hedging can act like an insurance policy, reducing risk by stabilizing revenue for producers. When oil prices fall lower than the prices at which producers established a hedge, the producer effectively receives higher revenues than selling at market prices. When oil prices rise higher than the hedged price, hedging results in a loss that is treated as an operating expense.

Comments and Discussion

There are no comments yet.

Add a Comment

Please log in or register to participate in comments and discussions.